It’s easy for your personal finances to get tangled up with your business finances. But no matter what type of business you’re running, it’s a good idea to keep your personal finances separate from those of your business.

Go Paperless

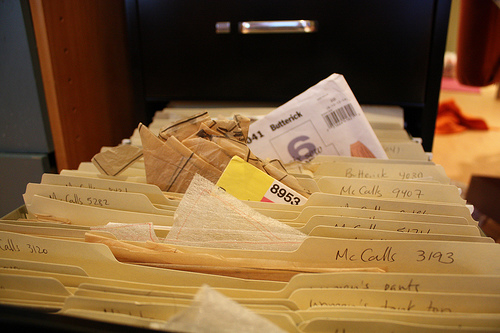

You know that amazing feeling when you get rid of clothes you haven’t worn in two years? Well getting rid of that filing cabinet filled with old bills and credit card statements can feel just as freeing. Scanning your important documents allows you to find them quickly, protects them from loss and makes your home-office less cluttered.

You know that amazing feeling when you get rid of clothes you haven’t worn in two years? Well getting rid of that filing cabinet filled with old bills and credit card statements can feel just as freeing. Scanning your important documents allows you to find them quickly, protects them from loss and makes your home-office less cluttered.

Of course, you shouldn’t just start tossing. The general rule is to hang onto tax records for seven years, and it might be easiest to keep the hard copies of those. But everything else—including bank and credit card statements, as well as pay stubs and receipts can be scanned and stored in a cloud-based filing provider, such as Dropbox or Google Drive.

Set up separate checking accounts OR Get a credit card for the business.

If you have separate checking or credit card account(s) you tend to be more diligent about drawing on the right account at the right time, come tax time, all you have to do is review your bank/card statements for a clear picture.